101 test - Application Delivery Fundamentals 2023 Updated: 2024

|

|

|

|

|

|

|

|

101 Application Delivery Fundamentals 2023

Section 1: OSI Cognitive Complexity

Objective 1.01 Explain, compare, and contrast the OSI layers

Describe the function of each OSI layer

Differentiate between the OSI layers

Describe the purpose of the various address types at different OSI layers

Objective 1.02 Explain protocols and technologies specific to the data link layer

Explain the purpose of a switchs forwarding database

Explain the purpose and functionality of ARP

Explain the purpose and functionality of MAC addresses

Explain the purpose and functionality of a broadcast domain

Explain the purpose and functionality of VLANs

Explain the purpose and functionality of link aggregation

Objective 1.03 Explain protocols and apply technologies specific to the network layer

Explain the purpose and functionality of IP addressing and subnetting

Given an IP address and net mask, determine the network IP and the broadcast IP

Given a routing table and a destination IP address, identify which routing table entry the destination IP address will match

Explain the purpose and functionality of Routing protocols

Explain the purpose of fragmentation

Given a fragment, identify what information is needed for reassembly

Explain the purpose of TTL functionality

Given a packet traversing a topology, document the source/destination IP address/MAC address changes at each hop

Objective 1.04 Explain the features and functionality of protocols and technologies specific to the transport layer

Compare/Contrast purpose and functionality of MTU and MSS

Explain the purpose and functionality of TCP

Explain the purpose and functionality of UDP

Explain the purpose and functionality of ports in general

Explain how retransmissions occur

Explain the purpose and process of a reset

Describe various TCP options

Describe a TCP checksum error

Describe how TCP addresses error correction

Describe how the flow control process occurs

Objective 1.05 Explain the features and functionality of protocols and technologies specific to the application layer

Explain the purpose and functionality of HTTP

Differentiate between HTTP versions

Interpret HTTP status codes

Determine an HTTP request method for a given use case

Explain the purpose and functionality of HTTP keepalives, HTTP headers, DNS, SIP, FTP

Differentiate between passive and active FTP

Explain the purpose and functionality of SMTP

Explain the purpose and functionality of a cookie

Given a situation in which a client connects to a remote host, explain how the name resolution process occurs

Explain the purpose and functionality of a URL

Objective 2.01 Articulate the role of F5 products

Explain the purpose, use, and benefits of APM, LTM, ASM, GTM

Objective 2.02 Explain the purpose, use, and advantages of iRules

Explain the purpose of iRules

Explain the advantages of iRules

Given a list of situations, determine which would be appropriate for the use of iRules

Objective 2.03 Explain the purpose, use, and advantages of iApps

Explain the purpose of iApps

Explain the advantages of iApps

Given a list of situations, determine which would be appropriate for the use of iApps

Objective 2.04 Explain the purpose of and use cases for full proxy and packet

forwarding/packet based architectures

Describe a full proxy architecture

Describe a packet forwarding/packet based architecture

Given a list of situations, determine which is appropriate for a full proxy architecture

Given a list of situations, determine which is appropriate for a packet based architecture

Objective 2.05 Explain the advantages and configurations of high availability (HA)

Explain active/active

Explain active/standby

Explain the benefits of deploying BIG-IP devices in a redundant configuration

Objective 3.01 Discuss the purpose of, use cases for, and key considerations related to load

balancing

Explain the purpose of distribution of load across multiple servers

Given an environment, determine the appropriate load balancing algorithm that achieves a desired result

Explain the concept of persistence

Objective 3.02 Differentiate between a client and server

Given a scenario, identify the client/server

Explain the role of a client

Explain the role of a server

Objective 4.01 Compare and contrast positive and negative security models

Describe the concept of a positive security model

Describe the concept of a negative security model

Given a list of scenarios, identify which is a positive security model

Given a list of scenarios, identify which is a negative security model

Describe the benefits of a positive security model

Describe the benefits of a negative security model

Objective 4.02 Explain the purpose of cryptographic services

Describe the purpose of signing

Describe the purpose of encryption

Describe the purpose of certificates and the certificate chains

Distinguish between private/public keys

Compare and contrast symmetric/asymmetric encryption

Objective 4.03 Describe the purpose and advantages of authentication

Explain the purpose of authentication

Explain the advantages of single sign on

Explain the concepts of multifactor authentication

Describe the role authentication plays in AAA

Objective 4.04 Describe the purpose, advantages, and use cases of IPsec and SSL VPN

Explain the purpose, advantages, and challenges associated with IPsec

Explain the purpose, advantages, and challenges associated with SSL VPN

Given a list of environments/situations, determine which is appropriate for an IPsec solution

Given a list of environments/situations, determine which is appropriate for an SSL VPN solution

Section 5: Application Delivery Platforms Cognitive

Complexity

Objective 5.01 Describe the purpose, advantages, use cases, and challenges associated

with hardware based application delivery platforms and virtual machines

Explain when a hardware based application deliver platform solution is appropriate

Explain when a virtual machine solution is appropriate

Explain the purpose, advantages, and challenges associated with hardware based application deliver platform

solutions

Explain the purpose, advantages, and challenges associated with virtual machines

Given a list of environments/situations, determine which is appropriate for a hardware based application

deliver platform solution

Given a list of environments/situations, determine which is appropriate for a virtual machine solution

Explain the advantages of dedicated hardware (SSL card, compression card)

Objective 5.02 Describe the purpose of the various types of advanced acceleration

techniques

Describe the purpose of TCP optimization

Describe the purpose of HTTP keepalives, caching, compression, and pipelining

F5-Networks Fundamentals test

Other F5-Networks exams

101 Application Delivery Fundamentals 2023201 BIG-IP Administrator

301 LTM Specialist

001-ARXConfig ARX Configuration

301b BIG-IP Local Traffic Manager (LTM) Specialist : Maintain & Troubleshoot

F50-522 F5 BIG-IP Local Traffic Management Advanced v9.4

F50-528 F5 ARX Configuring 5.x

F50-532 BIG-IP v10.x LTM Advanced Topics V10.x

F50-536 BIG-IP ASM v10.x (F50-536)

101 Braindumps

101 Real Questions

101 Practice Test

101 dumps free

F5-Networks

101

Application Delivery Fundamentals

http://killexams.com/pass4sure/exam-detail/101

Question #454

On a standalone BIG-IP ASM system, which of the following configuration is valid?

A. Pool named http_pool with 1 pool member, no persistence, and no load balancing method

B. Pool named http_pool with 3 pool members, cookie persistence, and ratio load balancing method

C. Pool named http_pool with 2 pool members, source IP persistence, and least connections load balancing

method

D. Pool named http_pool with 3 pool members, cookie persistence, and least connections load balancing method

Answer: A

Question #455

Which of the following violations cannot be learned by Traffic Learning?

A. RFC violations

B. File type length violations

C. Attack signature violations

D. Meta character violations on a specific parameter.

Answer: A

Question #456

What is the purpose of the IP addresses listed in the Trusted IP section when using Policy Builder?

A. Incoming requests with these IP addresses will never get blocked by BIG-IP ASM.

B. Incoming requests with these IP addresses will not be taken into account as part of the learning process, they

will be allowed to do anything.

C. Incoming requests with these IP addresses will automatically be accepted into the security

www.braindumps.com 87 F5 101 Exam policy, Policy Builder will validate that future requests with this traffic

will not create a violation.

D. Incoming requests with these IP addresses will be used by Policy Builder to create an alternate more advanced

security policy, this additional policy will not be enabled unless forced by the administrator.

Answer: C

Question #457

Which of the following protocols can be protected by Protocol Security Manager? (Choose three.)

A. FTP

B. SSH

C. HTTP

D. SMTP

E. Telnet

Answer: D

Question #458

Which of the following user roles have access to make changes to security policies? (Choose two.)

A. Guest

B. Operator

C. Administrator

D. Web Application Security Editor

Answer: CD

Question #459

Which of the following are methods BIG-IP ASM utilizes to mitigate web scraping vulnerabilities? (Choose two.)

A. Monitors mouse and keyboard events

B. Detects excessive failures to authenticate

C. Injects JavaScript code on the server side

D. Verifies the client supports JavaScript and cookies

Answer: AD

Question #460

When choosing Fundamental as the Policy Builder security policy type, BIG-IP ASM will learn and enforce the

following components? (Choose two.)

A. Attack signatures

B. Global parameters

C. HTTP protocol compliance

D. URLs and meta characters

Answer: AC

Question #461

Which of the following is a benefit of using iRules?

A. They can be used as templates for creating new applications

B. They provide an automated way to create LTM objects

C. They can use Active Directory to authenticate and authorize users

D. They provide a secure connection between a client and LTM

E. They enable granular control of traffic

Answer: E

Question #462

Which of the following is NOT a benefit of using SSL offload?

A. It enables iRules to be used on traffic arriving to LTM that is encrypted

B. The CPU processing led on backend servers is reduced

C. It enables LTM to decrypt traffic, examine the payload, and the re-encrypt before sending it to a pool member

D. The organization requires far less SSL certificates

E. It increases the bandwidth between the client and LTM

Answer: E

Question #463

When using a routed configuration, the real server must point to the LTM as the _________.

A. Default gateway

B. Virtual IP

C. DNS server

D. NTP server

E. WINS server

Answer: A

Question #464

Which three of these software modules can you layer on top of LTM on a BIG-IP device?

A. Enterprise Manage

B. ARX

C. APM

D. FirePass

E. Web Accelerator

F. GTM

Answer: CEF

Question #465

WebAccelerator uses three tiers to improve performance. What are the three tiers?

A. Web server offload

B. Network offload

C. Client offload

D. Protocol offload

E. Application offload

F. Bandwidth offload

Answer: ABE

Question #466

Which three of the following must be done in order for GTM to properly communicate LTM?

A. Ensure that GTM and LTM use the same floating IP address

B. Exchange SSL certificates between the two

C. Configure the GTM and LTM to use MAC masquerading

D. Connect the GTM and LTM with a network crossover cable

E. Synchronize the big3d versions between GTM and LTM

F. Add the LTM object to the GTM configuration

Answer: BEF

Integrating LTMsystems with GTM systems on a network

Running the bigip_add utility -

Determine the self IP addresses of the BIG-IP LTM systems that you want to communicate with BIG-IP GTM.

Run the bigip_add utility on BIG-IP GTM. This utility exchanges SSL certificates sothat each system isauthorized to

communicate with the other.

When the LTM and GTM systems use the same version of the big3d agent, you run the bigip_add utility toauthorize

communications between the systems. http://support.f5.com/kb/en-us/products/big-ip_gtm/manuals/product/gtm-

implementations11-3-0/7.html

Note:

The BIG-IP GTM and BIG-IP LTM systems must have TCP port 4353 open through the firewall between the systems.

The BIG-IP systems connect and communicate through this port.

For More exams visit https://killexams.com/vendors-exam-list

Kill your exam at First Attempt....Guaranteed!

F5 networks this week traded up 12% higher following reports that the company retained Goldman Sachs to represent the company in the wake of apparent buyout offers. In the past, F5 has surfaced as a potential acquisition target among the tech giants such as IBM , Cisco and Juniper . As is generally the case, neither Goldman nor F5 would comment. Although no deal has arisen from any previous such talks, here are reasons as to why F5 Networks might well consider a sell-off this time. Consider the following:

- Difficult Application Delivery Controller Market: According to Gartner, F5 Networks has remained a market leader and has seen market share gains in the ADC market in the past few years. Also, according to past reports, the ADC market was expected to grow at a CAGR of 12.5% during 2013-2018 period. However, given that F5’s product revenue growth has averaged around 6% only in the past 3 years, we shall be overly optimistic if we assume a 10% growth for the next 5 years. According to our model, we expect F5’s product revenue to grow at an average rate of approximately 5% during this period. This is a sharp decline as compared to F5’s product revenue growth of 29% between 2010-2012.

- Cloud based services may well disrupt the ADC market: Until a few years ago, before the popularity of cloud based services, we were clear about the fact that the ADC market size was directly proportional to the number of web applications being deployed. However, more and more applications are being deployed in the public cloud, where there is less need for a traditional load-balancer. For example, Amazon uses elastic load balancing , which is used to distribute incoming application traffic across multiple Amazon EC2 instances in the cloud, for applications using Amazon web services. Although F5’s load-balancer is customisable and is built on high-performance hardware, Amazon’s ELB is a bit different and it completely abstracts the hardware. Further, the plus point for an Amazon ELB is that it wipes out the hassle of installing and customizing a dedicated hardware for load balancing, which is a must in case of BIG-IP based products. Going ahead, cloud based load-balancers may well disrupt the traditional application delivery controller market, which can largely affect F5’s revenue growth. This is one key reason as to why we forecast F5’s product revenue to grow in mid-single digits and not experience double digit growth over the next 5 years.

- F5 Networks stock has relatively under-performed of late: Over the past one year, the company’s stock has hovered between a high of $134 and $86. For most of the time, the stock remained below the levels of $110. This can be attributed to a weak guidance for the coming quarters and a roughly flat revenue growth during this period. Further, the company also lost a patent battle against Radware which took a bite of its earnings during this period.

- The upcoming product refresh cycle can provide the much needed revenue growth: Though the company hasn’t provided the details of the upcoming product refresh cycle, F5 Networks is on its way for the hardware upgrade of its current line up of products. This upgrade holds the potential to boost the company’s short-term products revenue. F5’s high cash and no debt position, along with its short-term revenue growth prospects, makes it an attractive acquisition target at this time. The company can command a relatively higher premium if it sells-off itself at this point of time.

For information, please refer to our complete analysis for F5 Networks

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Like our charts? Embed them in your own posts using the Trefis WordPress Plugin.

F5 Networks on Monday went live with new sales and technical accreditation programs designed to help partners leverage its data networking products in a range of different scenarios.

Many channel partners understand better the role of application delivery controllers (ADC) in virtualization and cloud computing environments, said Dean Darwin, F5's vice president, worldwide channels. But many are also realizing the benefits of ADC in the greater context of the data center, including as a complement for security, storage, software and other forms of infrastructure.

F5's goal? To sell more F5 through partners using those inroads.

"We're the Swiss Army Knife of the data center," said Darwin in an interview with CRN. "Historically, we had so many networking partners, but now we're getting storage, and into the Microsoft, VMware and Oracle partners. I've got to get them up to speed on F5 and all the ways to use the technology."

As F5 has grown, so too have its routes to market, and among channel partners, the company now includes global integrators, telecom service providers and embedded partners as well as traditional VARs and distributors.

Darwin said that in recent years, F5's partner recruitment had been deliberately paced; it's grown the number of overall channel partners it has in its ranks by less than 3 percent. But now that the company is picking up so much interest from market segments adjacent to ADC but that touch the data center, it's time to to "turn on the spigot a little bit more," he said.

"This is business we weren't getting access to in the past," he said. "Am I going out to 10,000 Microsoft solution providers out there and hitting home runs with all of them? No. But there are a bunch now that I'm aware of, and they're aware of us. We're a bridge. We can have conversations and if you add virtualization, they get us pretty fast."

F5's new programs include 12 hours of technical training and 10 hours of sales training, offered in 12 modules. Each module is self-paced: Web-based e-learning accessed through the portal of F5's Unity Partner Program. Each includes a test and as partners take and pass each test, they can brand themselves as F5 solutions specialists in particular categories.

Of note is that there is both technical training and sales training, Darwin said, because F5 wanted to offer a program for sales managers to answer customer questions and get trained for field scenarios even if they don't need the deeper technical expertise an engineer would require.

The programs are open to any F5 partner, and they cost nothing for partners. Darwin declined to put a dollar amount to how much F5 has invested in the program, but said it's "very substantial" and consists of staff as well as cash.

Darwin said F5 signed off on fully funding the program because it sees long-term returns for having many, varied partners fully up to speed on how F5 solutions can be deployed in the marketplace. Accreditations aren't required for partners, but there will also be long-term incentives for those who get them.

"I'm going to give six months and let [partners] digest it," Darwin said. "Then I'm going to start tying tiers to it. I'm not going to force these guys to do anything, but there will be carrots at the end of it."

Ultimately, Darwin said, F5 is pushing toward a new level of partnership in the Unity Program whereby partners will be able to call themselves masters, and also specialize in particular areas -- including security, virtualization and acceleration -- related to ADC's use in the data center.

"We'll have this is in 2012," Darwin said. "This idea of an F5 architect -- this is not trivial."

NEXT: F5's Continued Growth

F5 saw about 35 percent percent year-over-year revenue growth from FY09 ($653 million) to FY10 ($882 million), and projects revenue between $265 million and $270 million for its fiscal first quarter 2011.

According to Gartner, it commands 61 percent share as the No. 1 player in the application delivery control market, and with a $1 billion run rate, said Darwin, things are "all going in the right direction."

Its success has made it attractive; among major hires in 2010, F5 pried David Aronica, now senior director of worldwide field readiness, away from years of partner enablement executive roles at VMware.

On the channel side, F5 has been successful in recruiting many of the national and global VARs well-entrenched with some of its rivals. Johannesburg, South Africa-based Dimension Data -- one of Cisco's top global strategic partners -- finally signed on with F5 in November 2010 after what Darwin described as five years of wooing.

Its longtime partners have celebrated the company's gains, too; many F5 VARs told CRN during last year's F5 partner conference that their business with the vendor had increased more than 100 percent even during a tough economic year.

The recession caused many solution providers to re-evaluate their practices, Darwin noted, but many also pushed their practices away from integrated solutions and back toward siloed technologies they knew they could sell in tough times.

That might have helped keep business afloat, Darwin said, but it also meant they missed opportunities to provide integrated solutions -- networking and virtualization, say -- and expand their value proposition.

"Many got caught off guard," Darwin said. "You have your FishNets and your Accuvants who did expand their offerings, and where did they take their market share from? The ones that didn't do it correctly."

In the coming year, F5 Networks will commit more resources to its partners than ever before, as the application delivery networking vendor sets its sites on bigger pieces of the security infrastructure, data center and cloud computing pies.

At F5 Networks' Agility conference in Chicago, where more than 560 partner representatives and 275 customers are in attendance, F5 has championed partners as the big push behind its march to $1 billion in revenue -- a milestone it expects to reach as its fiscal year ends in September.

What's coming next, said Steve McChesney, vice president, channel sales, Americas, is more from F5 in the areas of partner planning, partner marketing, partner services and partner-led profitability. Several key programs, including F5's current accreditation program and forthcoming certification offering, are designed to better equip partners taking F5 products into all pieces of the data center sale, from storage to security.

According to McChesney, F5's average deal size through partners is nearly $100,000 -- more than double of what it was a decade ago, and 10 percent larger than the previous year. McChesney urged partners to embrace the full gamut of F5 resources, including DevCentral, F5's user community portal for helping partners share best practices, built software and hear from F5 engineers.

DevCentral, said McChesney, offers access to more than 80,000 users and 500 pieces of sample material to "jumpstart" F5 projects.

Overall, F5 partners have a rich opportunity to have business transformation conversations with users on a cloud migration path. Using industry research from Enterprise Strategy Group and other sources, Dean Darwin, F5's vice president, worldwide channels identified three trends happening with customers on a worldwide basis.

First, he said, server virtualization is becoming ubiquitous, even if 58 percent of organizations have virtualized less than one third of their servers. Second, IT-owned workloads still dominate the customer landscape, and 59 percent of customers have not yet virtualized any mission-critical applications. Third, dynamic IT is still more a vision than a reality.

But those trends still reflect the reality of how channel partners need to engage customers. F5, said Darwin, solves a lot of the problems customers have at the application layer -- a point made repeatedly by other F5 executives at Agility -- and partners need to bring F5 products in as business conversations, not as product resale.

"The selling lanes have changed," Darwin said, referencing financial legend Warren Buffett's thought that "only when the tide goes out do you discover who's been swimming naked."

Coming rapidly into focus, Darwin said, are that large VARs and systems integrators are building their own cloud offerings, and are looking to partner with cloud providers, such as Rackspace, as cloud services agents.

That makes all the sense in the world for F5's channel, Darwin said, because its products and services fit between so many different data center disciplines.

"And we are absolutely getting into the ring when it comes to security," he added, referencing a push by F5 to become better known as a security infrastructure player as much as it is an application delivery networking vendor.

"F5 can be a door opener for a lot of discussions," he said. "The closer you get to the application, the healthier you're going to be and the more business discussions you're going to have."

Tim Abbott, solutions architect at Trace 3, a security solution provider and F5 partner based in Irvine, Calif., said Trace 3 had in the past positioned F5 before as a load balancer, or for its Global Traffic Manager (LTM) capability in the BIG-IP platform, or any one or several capabilities the F5 product set offers. The upsell opportunity, with more customers looking to make their data centers more efficient, is enormous.

"We're only scratching the surface with our customers on all the features it can provide," he said.

Trace 3 sells the entire F5 portfolio and has seen its F5 sales grow nearly 40 percent year-over-year. F5's positioning -- for partners to focus on the business transformation that comes from optimizing applications -- is spot-on, Abbott said.

"Who cares about servers, we care about the applications," he said. "When you're virtualizing an infrastructure, you're asking what applications are you trying to virtualize and how are you making that application better to the customer. Once you figure out what applications you want to virtualize, you'll get the funding. If you can make the app faster, the doors are open. Once those doors are open, I can sell you the F5 product."

Next: F5's Vendor Partnerships Bear Fruit

Partners said that another big piece of F5's appeal is how its products can fit with those of data center-focused vendors with a big stake in the cloud computing move.

Rackspace, for example, told F5 partners Thursday it will be doing more to encourage joint F5-Rackspace solution sales.

Robert Fuller, vice president of worldwide channels, and John Engates, CTO, at Rackspace, said that hosted cloud provider will grandfather F5 partners into the tier equivalent, in Rackspace's channel program, of their F5 Unity partner program status -- an announcement that brought applause from the F5 crowd.

"Let's bridge that into the Rackspace program, so you get the high-level compensation," Engates said.

The companies will partner in other ways, too. F5 plans to credit the F5 portion of a solution hosted at Rackspace toward an F5 partner's partner tier attachment, Fuller said. There will also be joint sales development between the two companies, and payment acceleration options that let VARs draw from future compensation payments by Rackspace to offset upfront costs.

Storage ace NetApp was another F5 vendor partner at Agility touting greater vendor alignment between the two channels. Jim Sangster, senior director of solutions marketing at NetApp, said he's seeing the opportunity for NetApp storage and F5 infrastructure sales to expand, with more customers looking for seamless migration paths to cloud.

"The discussion around the applications is really what it's all about," Sangster told partners.

F5's FFIV shares jumped 21.2% post fourth-quarter fiscal 2023 earnings release, buoyed by strong performance. The surge showcases investors' trust in F5's solid finances and its strategic position in application delivery, networking and security solutions.

FFIV's earnings has outpaced estimates in each of the trailing four quarters, delivering an average surprise of 7.76%. This indicates an impressive track record of exceeding earnings estimates. Moreover, the company has a long-term earnings growth expectation of 5.4%.

The stock carries a Zacks Rank #2 (Buy) and has a Growth Score of B at present. The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 (Strong Buy) or #2 and a Growth Score of A or B offer solid investment opportunities.

With healthy fundamentals, the stock appears to be a solid investment option at the moment.

F5, Inc. Price and Consensus

F5, Inc. price-consensus-chart | F5, Inc. Quote

Growth Drivers

F5’s stronger-than-expected fourth-quarter fiscal 2023 results have boosted investors’ confidence. F5 Networks stands out to benefit from the booming application networking market. With a strong hold in Layer 4-7 content switching and a solid position in data centers, the company is poised to expand market share, especially given the increasing demands for capacity and security in next-gen applications.

F5 is one of the major players in the application delivery controller (ADC) market, offering vital products for data center consolidation, virtualization and cloud services. Additionally, F5 has gained significant market share due to Cisco's shift away from the core ADC market. It is also a major developer and provider of software-defined application services, ensuring secure, speedy and accessible applications across IP networks on any device and at any time.

FFIV collaborated with industry leaders, including Microsoft, Oracle, VMware, Cisco Systems and HP, to offer integrated application services for their Software Defined Networking offerings. It has also partnered with Amazon Web Services, Microsoft Azure, VMware vCloud Air, Cisco ACI and others for cloud-based application services. These partnerships increase access to new tech, aid product innovation, strengthen F5's cybersecurity suite, support joint sales and marketing efforts, and enhance its competitive edge.

The company is altering its business model by focusing on subscription-based services, which generate steady revenues and increase profits. The company has also made cost-saving moves like reducing staff, trimming facility space and cutting travel. These initiatives are aimed at lowering operating expenses and improving margins in the short run. Moreover, F5 boasts a strong balance sheet, ample liquidity and reduced debt, making it lucrative to investors.

Other Key Picks

Logitech LOGI, carrying a Zacks Rank #2 at present, is capitalizing on the surge of hybrid work patterns, which are expected to increase the need for its video collaboration tools, keyboards, combos and pointing devices. The thriving cloud-based video conferencing services remain a primary driving force behind this. You can see the complete list of today’s Zacks #1 Rank stocks here.

The growing adoption of new mobile platforms in both mature and emerging markets is driving Logitech's peripherals and accessories demand. Additionally, the company has been able to leverage its software and go-to-market capabilities to increase its market share.

The consensus mark for fiscal 2024 earnings has moved north 11 cents to $3.43 per share over the past 60 days, indicating a 6.52% increase from the fiscal 2023 level. LOGI has a Growth Score of A.

NVIDIA Corporation NVDA, carrying a Zacks Rank #2 at present, is reaping the rewards of increased investments in generative AI. The surge in generative AI technology is poised to create substantial demand for its next-gen high-performance computing chips. With rising investments in AI across the data center sector, NVDA anticipates its fourth-quarter fiscal 2024 revenues to soar to $20 billion from $6.05 billion in the previous year’s quarter.

NVIDIA maintains a dominant position in the AI chip market, with its GPUs already integrated into AI models. This expansion of NVDA’s reach is extending into previously untapped sectors, such as automotive, healthcare and manufacturing. Collaborations with Mercedes-Benz and Audi are poised to further bolster NVIDIA's presence in autonomous vehicles and other automotive electronics domains.

The consensus mark for fiscal 2024 earnings has been revised upward by 12 cents to $12.29 per share over the past 30 days, indicating a whopping 268% increase from fiscal 2023. The stock has a Growth Score of A and has a long-term earnings growth expectation of 13.5%.

CrowdStrike CRWD carries a Zacks Rank #2 and has a Growth Score of A. CRWD is capitalizing on heightened demand for cyber-security solutions, driven by numerous data breaches and the growing necessity for security and networking products amid the rise of hybrid work practices.

Ongoing digital transformations and the migration to cloud services within organizations serve as pivotal factors driving growth. The company's robust portfolio, including the Falcon platform's 10 cloud modules, fortifies its competitive advantage and attracts new users. Furthermore, strategic acquisitions like Bionic and Reposify are anticipated to propel further growth.

The Zacks Consensus Estimate for CrowdStrike’s fiscal 2024 earnings has moved north 12 cents in the past 30 days to $2.94 per share, indicating growth of 90.9% on a year-over-year basis. The long-term expected earnings growth rate for CRWD is pegged at 36.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

F5, Inc. (FFIV) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

BRAZIL - 2021/04/15: In this photo illustration, the F5 Networks logo seen displayed on a smartphone ... [+]

SOPA Images/LightRocket via Getty ImagesGiven its better prospects, we believe Ciena stock (NYSE: CIEN), a network hardware, software, and services provider, is a better pick than its sector peer, F5 Networks stock (NASDAQ NDAQ : FFIV), an application security and cloud networking company. Investors have assigned a higher valuation multiple of 3.7x revenues for FFIV compared to 1.5x revenues for CIEN due to F5’s superior revenue growth and profitability. The decision to invest often comes down to finding the best stocks within the parameters of certain characteristics that suit an investment style. The size of profits can matter, as larger profits can imply greater market power. In the sections below, we discuss why we believe that CIEN will offer better returns than FFIV in the next three years. We compare a slew of factors, such as historical revenue growth, stock returns, and valuation, in an interactive dashboard analysis of F5 vs. Ciena CIEN : Which Stock Is A Better Bet? Parts of the analysis are summarized below.

FFIV stock has seen little change, moving slightly from levels of $175 in early January 2021 to around $175 now, while CIEN stock has seen a decline of 20% from levels of $55 to around $45 over the same period. In comparison, the S&P500 index saw an increase of about 25% over this roughly three-year period.

Overall, the performance of FFIV stock with respect to the index has been lackluster. Returns for the stock were 39% in 2021, -41% in 2022, and 21% in 2023. Similarly, however, the decrease in CIEN stock has been far from consistent. Returns for the stock were 46% in 2021, -34% in 2022, and -13% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 23% in 2023 - indicating that FFIV and CIEN underperformed the S&P in 2022 and 2023.

In fact, consistently beating the S&P 500 - in good times and bad - has been difficult over recent years for individual stocks; for heavyweights in the Information Technology sector, including AAPL, MSFT, and NVDA, and even for the megacap stars GOOG, TSLA, and AMZN. In contrast, the Trefis High Quality Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index, less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could FFIV and CIEN face a similar situation as they did in 2022 and 2023 and underperform the S&P over the next 12 months - or will they see a strong jump? While we expect both stocks to move higher in the next three years, we think CIEN will fare better.

1. F5’s Revenue Growth Is Better

- F5’s revenue growth has been better, with a 6.2% average annual growth rate in the last three years, compared to 0.6% for Ciena.

- FFIV revenues rose from $2.4 billion in fiscal 2020 (fiscal ends in September) to $2.8 billion in 2023, led by services and product revenue growth due to increasing demand and entry into new markets.

- For Ciena, revenue increased from $3.5 billion in fiscal 2020 (fiscal ends in October) to $4.4 billion in 2023, led by continued growth in Global Services Platform Software and Services, while the Networking Platforms business also saw a rebound in fiscal 2023.

- Supply chain issues weighed on the company’s overall performance in the recent past, and it still remains a concern.

- Ciena expects its routing and switching business to grow faster in the coming years and drive the overall top-line growth.

- If we look at the last twelve-month period revenues, Ciena fares better with sales growth of 14% vs. 5% for F5.

- Our F5 Revenue Comparison and Ciena Revenue Comparison dashboards provide more insight into the companies’ sales.

- Looking forward, we expect Ciena to see better sales growth than F5. We forecast F5’s top-line to expand at a CAGR of 3.4% to $3.1 billion in three years, while Ciena will likely see its sales rise in a mid-single-digit average annual growth rate to $5.3 billion over this period, based on Trefis Machine Learning analysis.

2. F5 Is More Profitable

- F5’s operating margin declined from 23.1% in 2019 to 15.0% in 2022, while Ciena’s operating margin contracted from 14.5% in fiscal 2020 to 8.8% in 2023.

- Looking at the last twelve-month period, F5’s operating margin of 14.6% fares better than 8.8% for Ciena.

- F5’s margin metric has been weighed down due to a rise in component costs.

- Our F5 Operating Income Comparison and Ciena’s Operating Income Comparison dashboards have more details.

- Looking at financial risk, F5 fares better. F5 is a debt-free company, while Ciena’s debt as a percentage of equity is around 24%. However, Ciena’s 22% cash as a percentage of assets is higher than 13% for F5, implying that F5 has a better debt position and Ciena has more cash cushion.

3. The Net of It All

- We see that F5 has seen better revenue growth and is more profitable.

- Now, looking at prospects using P/S as a base, due to high fluctuations in P/E and P/EBIT, we believe Ciena will offer higher returns in the next three years.

- Also, if we compare the current valuation multiples to the historical averages, CIEN fares better. F5 stock is trading at 3.7x revenues compared to its last five-year average of 4.3x. In comparison, Ciena stock trades at 1.7x revenues vs. the last five-year average of 2.2x.

- Our F5 Valuation Ratios Comparison and Ciena Valuation Ratios Comparison have more details.

- The table below summarizes our revenue and return expectations for both companies over the next three years and points to an expected return of -12% for FFIV over this period vs. a 31% expected return for CIEN, based on Trefis Machine Learning analysis – F5 vs. Ciena – which also provides more details on how we arrive at these numbers.

FFIV stock versus CIEN stock

TrefisWhile CIEN stock may outperform FFIV, it is helpful to see how F5’s peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

FFIV Return Compared with Trefis Reinforced Value Portfolio

TrefisInvest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

A month has gone by since the last earnings report for F5 Networks (FFIV). Shares have added about 10.2% in that time frame, outperforming the S&P 500.

Will the recent positive trend continue leading up to its next earnings release, or is F5 due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

F5 Surpasses Earnings and Revenue Estimates in Q4

F5 reported better-than-expected fourth-quarter fiscal 2023 results. This Seattle, WA-based company’s non-GAAP earnings of $3.50 per share beat the Zacks Consensus Estimate of $3.22 and increased 33.6% from the year-ago quarter’s $2.62 per share.

The bottom line was also way higher than management’s guided range of $3.15-$3.27 per share. The robust bottom-line performance reflects the combined impact of gross margin improvement and disciplined operating expense management.

F5 revenues of $707 million for the fourth quarter surpassed the consensus mark of $701.6 million. Moreover, on a year-over-year basis, revenues increased 1% and came toward the high end of management’s guidance range of $690-$710 million despite persistent macroeconomic uncertainties and tight budgets of customers.

Top Line in Detail

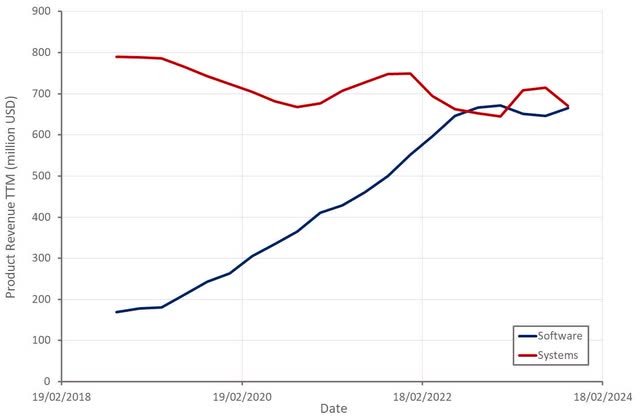

Product revenues (46% of total revenues), which comprise the Software and Systems sub-divisions, decreased 7% year over year to $325 million. The decline in Product revenues was mainly due to lower Systems sales, partially offset by increased Software sales. The company’s reported non-GAAP Product revenues were slightly higher than our estimates of $324.4 million.

Systems revenues plunged 25% year over year to $134 million, accounting for approximately 41% of the total Product revenues. The company revealed that the decline reflects a lower level of backlog-related shipments compared to prior quarters, while the demand shows some signs of stabilization. Our estimates for Systems revenues were pegged at $152.6 million.

However, the negative impacts of lower Systems sales were offset by the strong performance of Software. Software revenues soared 11% year over year to $191 million in the fourth quarter. Our estimates for Software’s fourth-quarter revenues were pegged at $171.7 million.

Global Service revenues (54% of the total revenues) grew 9% to $382 million. The robust growth was mainly driven by price increases introduced last year and the benefits of high-maintenance renewals. Our estimates for Global Services revenues were pegged at $376.5 million.

F5 Networks registered sales growth across the EMEA and APAC regions, witnessing a year-over-year increase of 16% and 4%, respectively. However, revenues from the Americas region fell 6% on a year-over-year basis. Revenue contributions from the Americas, EMEA and APAC regions were 57%, 26% and 17%, respectively.

Customer-wise, Enterprises, Service providers and Government represented 72%, 9% and 19% of product bookings, respectively.

Margins

On a year-over-year basis, GAAP and non-GAAP gross margins expanded 120 basis points (bps) and 130 bps to 80.1% and 82.7%, respectively. We believe that the improvement could be primarily driven by price realization and ease in supply-chain constraints, as well as reductions in ancillary supply-chain costs.

The company’s fourth-quarter GAAP operating expenses went down 11.4% to $394.3 million, while non-GAAP operating expenses declined 9% to $344.8 million. GAAP operating expenses as a percentage of revenues decreased to 55.8% in the fourth quarter of fiscal 2023 from 63.6% in the year-ago quarter. Meanwhile, non-GAAP operating expenses as a percentage of revenues declined to 48.8% from 54.1% in the year-ago quarter.

F5 Networks’ GAAP operating profit jumped 59.3% to $172 million, while the margin expanded 890 bps to 24.3%. Moreover, the non-GAAP operating profit jumped 25.7% year over year to $240 million, while the margin improved 660 bps to 33.9%. An increase in the non-GAAP operating margin was primarily driven by an improvement in the gross margin and lower operating expenses as a percentage of revenues.

Balance Sheet & Cash Flow

F5 Networks exited the September-ended quarter with cash and short-term investments of $808 million compared with the previous quarter’s $690.6 million.

The company generated operating cash flow of $190 million in the fourth quarter and $653.4 million in the full fiscal 2023.

During the quarter, FFIV repurchased shares worth $60 million. In fiscal 2023, it bought back common stocks worth $350 million. As of Sep 30, 2023, F5 had $922 million remaining under its current authorized share repurchase program. Year to date, the company has utilized about 58% of its free cash flow for share buybacks compared with its commitment of using at least 50% of free cash flow for share buybacks announced at the beginning of fiscal 2023.

Guidance

F5 Networks projects non-GAAP revenues in the $675-$695 million band (midpoint of $685 million) and non-GAAP earnings per share in the $2.97-$3.09 band (midpoint of $3.03) for the first quarter of fiscal 2024. The non-GAAP gross margin is forecast between 82% and 83%.

The company expects first-quarter non-GAAP operating expenses between $332 million and $344 million. Share-based compensation expenses are anticipated in the range of $58-$60 million.

For fiscal 2024, F5 forecasts revenues to be flat to a low-single-digit-percentage decline range. Non-GAAP gross and operating margins are anticipated in the ranges of 82-83% and 33-34%, respectively. The effective tax rate for fiscal 2024 is projected in the 21 band.

The company forecasts non-GAAP earnings per share to increase 5-7% in fiscal 2024. Moreover, it intends to return at least 50% of its fiscal 2024 free cash flow to shareholders through share buybacks.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended downward during the past month.

VGM Scores

At this time, F5 has a nice Growth Score of B, though it is lagging a lot on the Momentum Score front with a D. Charting a somewhat similar path, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Outlook

Estimates have been broadly trending downward for the stock, and the magnitude of these revisions indicates a downward shift. Notably, F5 has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

F5, Inc. (FFIV) : Free Stock Analysis Report

piranka

Despite the stock performing well over the past five months, F5, Inc.'s (NASDAQ:FFIV) returns in 2023 are still only in line with broader indices. This is counter to my expectation of poor performance due to:

- Declining product sales in the face of backlog headwinds.

- Depressed margins as a result of investment in new product lines.

- Questionable prospects for new product lines.

While system sales are expected to drop sharply going forward and F5's new businesses have so far demonstrated limited traction, margins have rebounded sharply due to F5's focus on expenses. This, along with a modest valuation, has helped F5's stock perform strongly in the second half of 2023.

Market

F5 stated on its fourth quarter earnings call that the demand environment has shown signs of stabilization, particularly amongst enterprise customers. F5's hardware orders reportedly rebounded in the fourth quarter, supporting this view. In terms of verticals, technology and financial services customers were areas of strength, offset by service provider weakness. Service providers are delaying asset purchases and prioritizing spending.

F5 expects continued growth in FY2024, driven by automation and generative AI. F5 also believes that customers will be forced to begin investing in application infrastructure again. Given the boom in hardware spending over the past three years it is not obvious that this will be the case though. Some customers have obviously delayed purchases due to financial pressure, but I would be surprised if this represents a majority, or even a significant minority of customers.

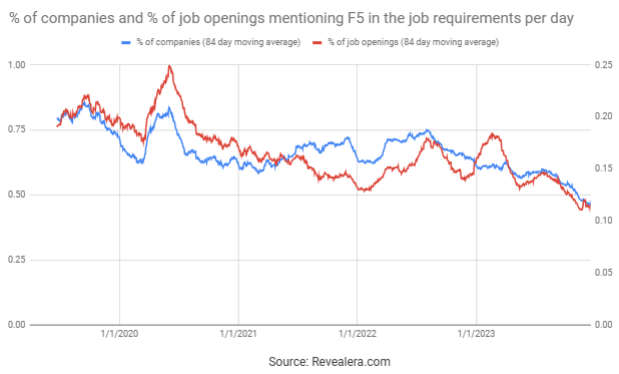

Figure 1: Job Openings Mentioning F5 in the Job Requirements (source: Revealera.com)

F5

F5 provides a range of solutions that help to deliver, secure and optimize applications and APIs across any environment. It has both hardware and software offerings, many of which have come through acquisitions. F5 is still in the process of integrating these solutions into a converged solution though.

This is change that has been necessitated by the growing importance of the cloud and edge computing, which has changed how applications are developed and deployed. While F5 has positioned itself to remain relevant, there is a large amount of uncertainty regarding what extent acquisitions will offset structural headwinds to F5's legacy business.

F5's Distributed Cloud Services offering now has over 500 customers, more than a 200% increase YoY. Penetration has predominantly been within F5's existing customer base so far though, with only 29% of Distributed Cloud customers new to F5. WAF and multi-cloud networking are F5's first two distributed cloud solutions. CDN capabilities were also recently added through the acquisitions of Lilac, and F5 has a backlog of other services it wants to add to the platform.

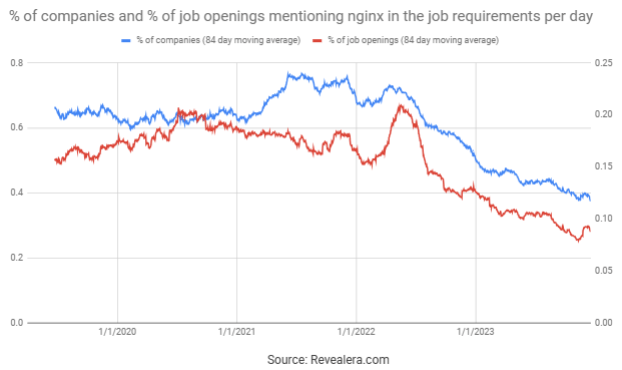

F5 is seeing continued adoption of NGINX amongst larger enterprises for their cloud and Kubernetes workloads. Customers are also leveraging NGINX for app layer security for containers. NGINX serves modern, container-native and microservices-based applications and APIs.

Figure 2: Job Openings Mentioning NGINX in the Job Requirements (source: Revealera.com)

While F5's ADC business will continue to face headwinds, the company continues to invest in it, and as a result, expects to take a share in both hardware and software form factors. F5 aims to provide on-prem deployments with the benefits of the cloud (multi-tenancy, rapid upgrades, etc.) while lowering total cost of ownership. F5's rSeries and VELOS platforms represented more than 80% of Q4 systems bookings. rSeries is designed on a new microservices-based platform layer and an API-first architecture. It supports BIG-IP app delivery and security services and aims to lower costs through consolidation. VELOS is a next-generation chassis system that aims to provide performance and scalability in a single ADC. Customers can scale capacity by adding modular blades in a chassis, without disrupting users or applications.

Security is an important part of F5's business, contributing approximately 1.1 billion USD revenue in FY2023. F5 was disappointed with the performance of its most advanced anti-bot and anti-fraud managed service solutions this year, which it attributed to customer spending caution and budget scrutiny. F5 has reportedly seen good traction with its lower-end Distributed Cloud anti-bot offering though, as well as from security on NGINX.

AI

Like most edge computing companies, F5 is counting on AI inference workloads to provide a tailwind. Organizations will need to support inference across datacenters, public clouds and the network edge, which F5 believes it is positioned to support. While inference could begin to create incremental demand in 2024, I think it is still too early for this to be material for companies like F5.

F5 also expects the use of AI to accelerate growth in the number of applications and APIs, which would naturally be a tailwind for F5's business. The number of applications is likely to be limited by demand rather than supply though. Applications require users and organizations must acquire these users, the real bottleneck to growth in most cases.

Financial Analysis

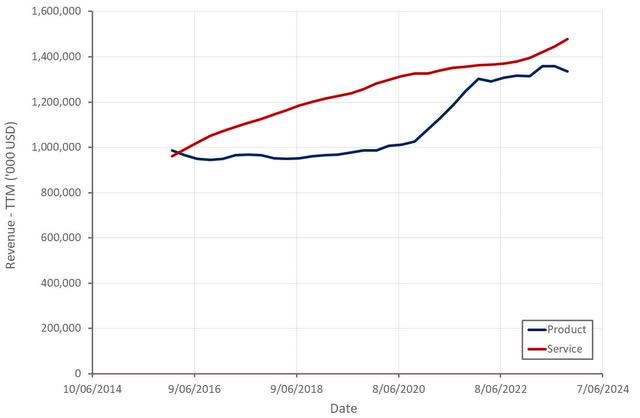

F5's fourth quarter revenue was 707 million USD, a 1% increase YoY, with 54% of revenue coming from services and 46% from product. Services revenue grew 9% on the back of high maintenance renewals and price increases. Service revenue is likely to moderate going forward as F5 laps price increases and spending on upgrades versus maintenance normalizes. Product revenue increased 7% YoY, with systems revenue down 25% due to lower backlog related shipments.

Figure 3: F5 Revenue (source: Created by author using data from F5 Networks)

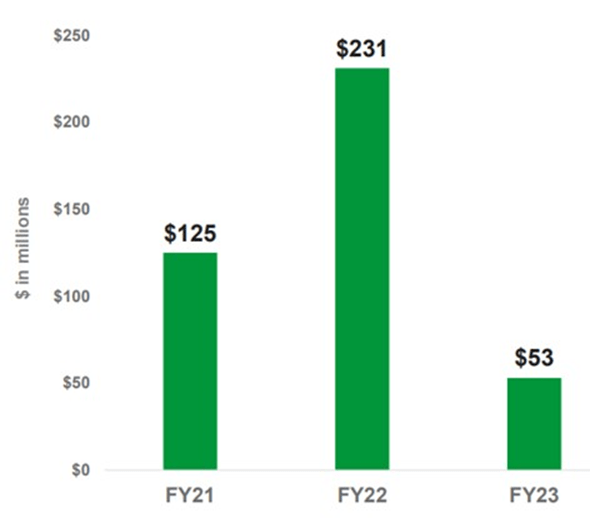

Backlog has now returned to normal levels, which will present roughly a 180 million USD revenue headwind in FY2024.

Figure 4: F5 Product Backlog (source: F5 Networks)

BIG-IP and NGINX term subscriptions were up 9% in FY23. SaaS (includes Distributed Cloud) and managed services only increased 2% though. F5 has stated that it is seeing solid momentum from its Distributed Cloud business, but this isn't apparent in public data. Some of this is the result of planned revenue churn. Managed services include F5's legacy Silverline offering as well as some legacy SaaS solutions. F5 is currently in the process of migrating customers from its Silverline solution to the Distributed Cloud offering, which is creating headwinds. The company is also abandoning some legacy SaaS offerings from the companies it acquired. This process involves 65 million USD ARR in total, half of which is from offerings that F5 is retiring completely. The process is expected to be completed over the next year. F5's perpetual license software revenue was also down in FY2023, although the company attributed this to an unusually strong prior year.

Figure 5: F5 Product Revenue (source: Created by author using data from F5 Networks)

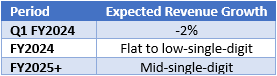

F5 expects customer caution to continue in FY2024 but also believes that customers will need to begin replacing assets again in the next year. Software is expected to provide flat to modest revenue growth due to headwinds from the transition of SaaS and managed service offerings. Global services revenue is expected to return to low-single-digit growth as F5 laps price increases. As a result, FY2024 revenue is expected to be flat to down low-single-digits YoY. F5 expects to return to mid-single-digit revenue growth in FY2025 though.

Table 1: F5 Revenue Guidance (source: Created by author using data from F5 Networks)

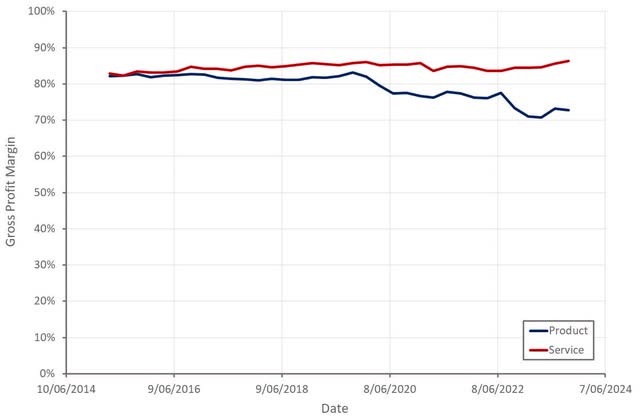

While F5 has suggested that supply chain issues have largely resolved and delivery times normalized, F5's product margins remain depressed. How much if this is due to revenue mix, versus declining system or software margins is unclear though. This is an important trend to watch as F5 needs to maintain high gross profit margins to support investment in its security and distributed cloud businesses.

Figure 6: F5 Gross Profit Margins (source: Created by author using data from F5 Networks)

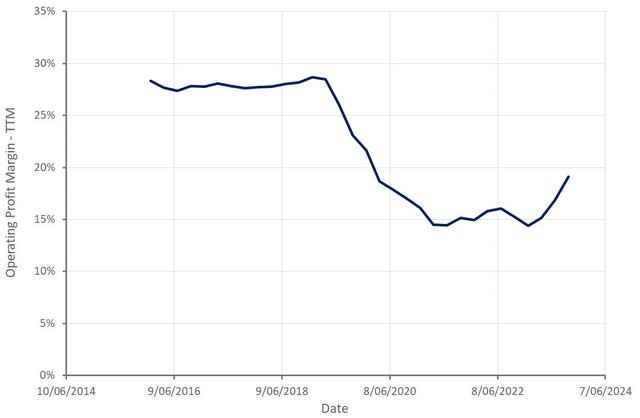

While gross profit margins remain under pressure, F5's operating profit margins have rebounded sharply in recent quarters, with much of the change driven by improved sales and marketing efficiency.

F5 has been focused on reducing its operating expenses, but given the company's ambitions, it still needs to invest in product development and customer acquisition. How these dynamics play out in coming quarters will have a large impact on F5's share price going forward.

Figure 7: F5 Operating Profit Margin (source: Createed by author using data from F5 Networks)

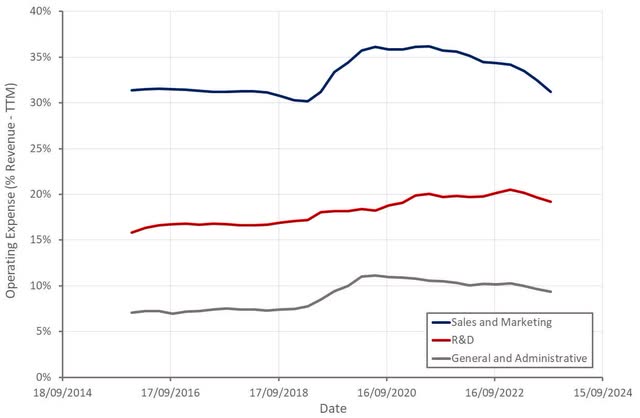

Figure 8: F5 Operating Expenses (source: Created by author using data from F5 Networks)

Conclusion

Despite the stock moving around 20% higher over the past two months, F5 still appears reasonably valued, with the company's EV/S multiple towards the lower end of its historical range. Investors need to weigh its valuation against uncertain growth prospects and the potential for margin compression as the company invests in growth initiatives. The fact that software revenue has been fairly flat over the past 15 months and is expected to remain fairly flat over the next 12 months is hardly comforting. The recent drop in sales and marketing expenses also isn't suggestive of a company capitalizing on a large growth opportunity. F5's internal expectations are for long-term software growth in excess of 20%, offset by high to mid-single digit systems revenue decline. If F5's distributed cloud business struggles, the stock could still prove expensive at current levels.

Figure 9: F5 EV/S Multiple (source: Seeking Alpha)

F5 Networks, Inc. is a provider of multi-cloud application services which enable its customers to develop, deploy, operate, secure, and govern applications in any architecture, from on-premises to the public cloud. The Company's enterprise-grade application services are available as cloud-based, software-as-a-service, and software-only solutions optimized for multi-cloud environments, with modules that can run independently, or as part of an integrated solution on its appliances. In connection with its solutions, the Company offers a range of professional services, including consulting, training, installation, maintenance, and other technical support services. The Company's customers include large enterprise businesses, public sector institutions, Governments, and service providers. It conducts its business globally and manage its business by geography. Its business is organized into three geographic regions: Americas; Europe, Middle East, and Africa; and the Asia Pacific region.

101 Practice Test | 101 study | 101 exam | 101 answers | 101 study help | 101 course outline | 101 tricks | 101 learn | 101 benefits | 101 answers |

Killexams Exam Simulator

Killexams Questions and Answers

Killexams Exams List

Search Exams